Rethinking Investment Research for the Modern Asset Manager

Our mission is to deliver systematic, scalable insights that work alongside your team's expertise.

Intelligence datasets and AI tools to drive data-driven decisions

One solution to augment all processes

Let data driven analysis fuel your entire research process

Our Products

Our product suite is designed to support institutional investors across the research, portfolio construction, and risk management lifecycle. From signal generation to explainability and API integrations, our tools are built to integrate seamlessly into your investment workflows.

ValQuantIDX

AI Driven Indices for the stock markets

Our Intelligence Suite

AlphaRank

Predictive Stock Rankings for High-Conviction Selection

RiskX

Predictive Risk Ratings For Robust Portfolio Construction

AltIQ

Explainable Intelligence from Financial Markets Datasets

EdgeAI

AI that leverages our datasets and delivers interpretable insights

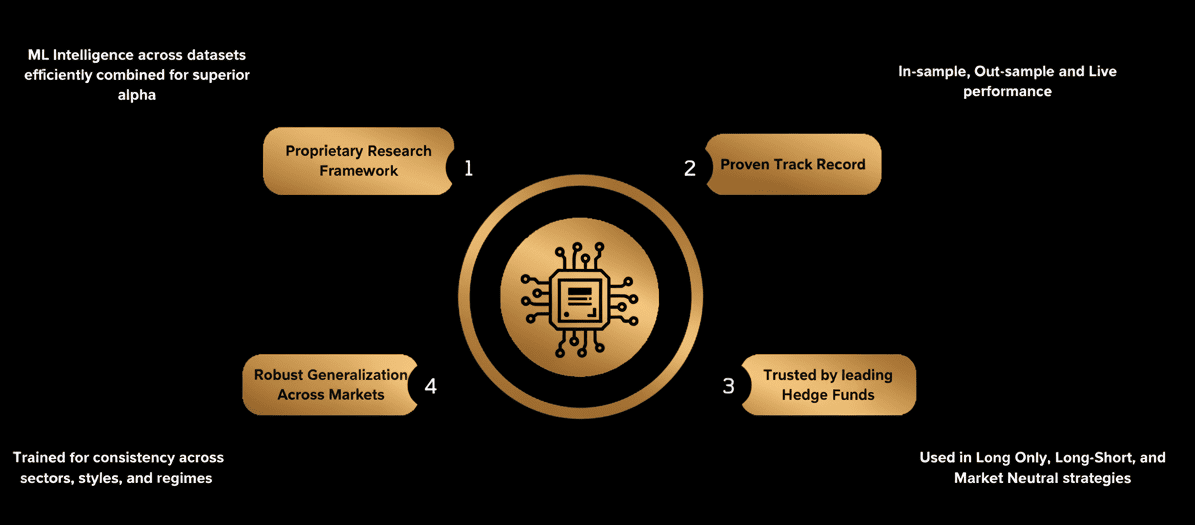

Built For Institutional Edge

Institutional-Grade Intelligence, Proven by Performance

Our edge lies in transforming fragmented data into unified, alpha-generating intelligence—built for the most sophisticated investors.

Empower Your Investment Process

Whether you're looking to enhance your existing research process or explore new sources of alpha, ValQuant’s solutions are built to support institutional investment teams at scale. Let’s discuss how we can help you unlock data-driven insights with measurable impact.